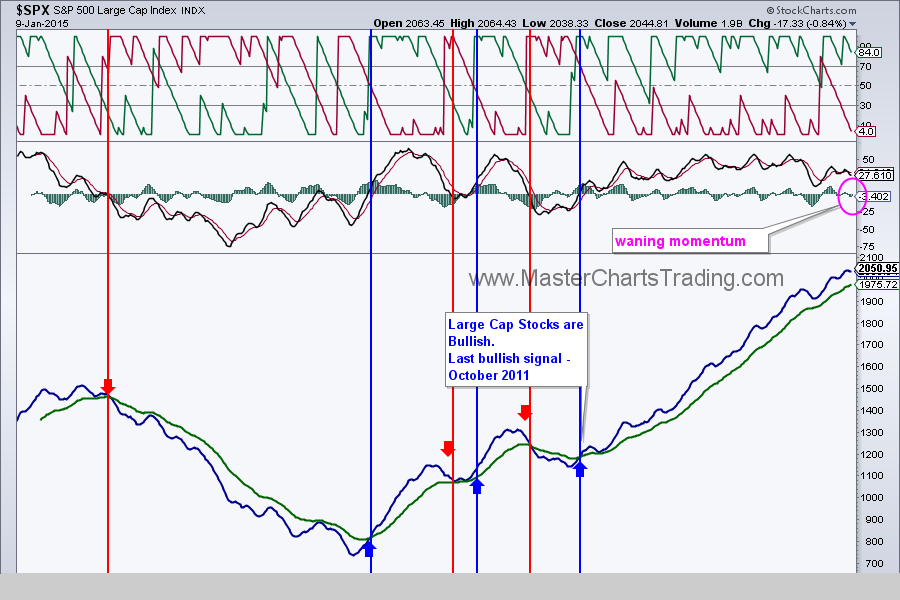

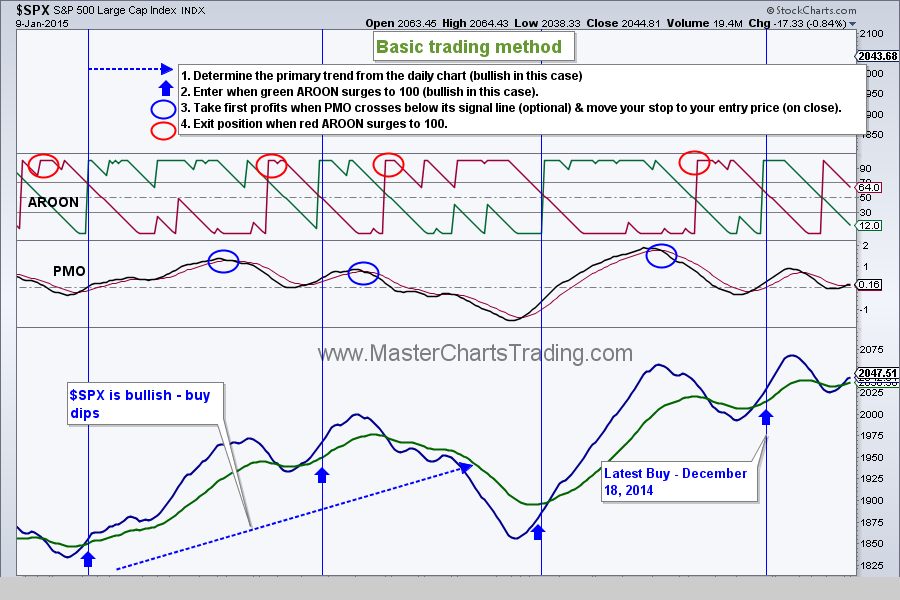

| Friday, January 9, 2015 Weekly Market Recap. Thelong-term picture for stocks remains the same – stock market in the USA is bullish. | |

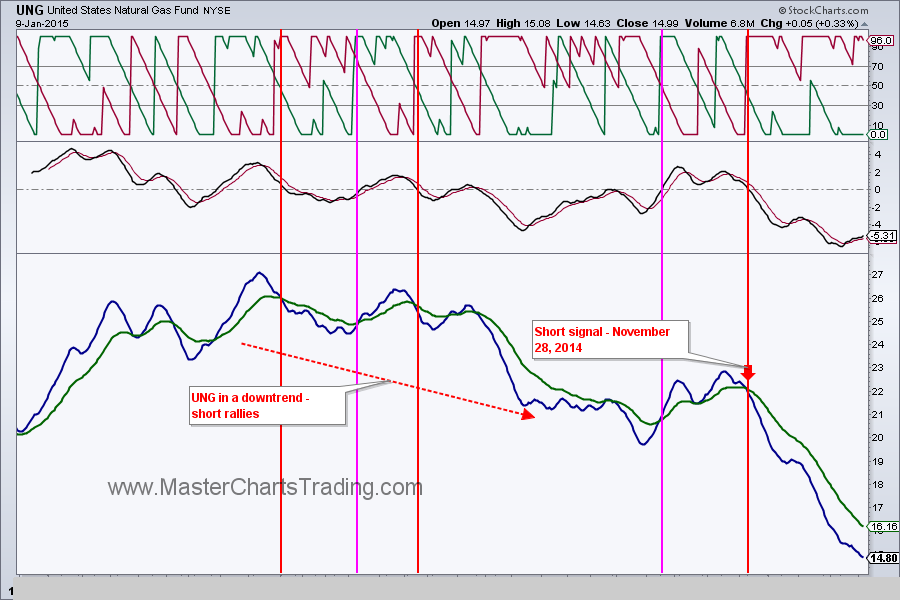

$NATGAS entered its most recent bear market around February 2014. Since then there were 3 good selling opportunities (according to our trading system). One of them would have resulted in a breakeven, but the other two would have resulted in about 15 and 30% profits. These are marked on the chart of UNG below.

Watch for the signals on our hourly $UNG chart to see if a tradable bear market rally is unfolding.

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

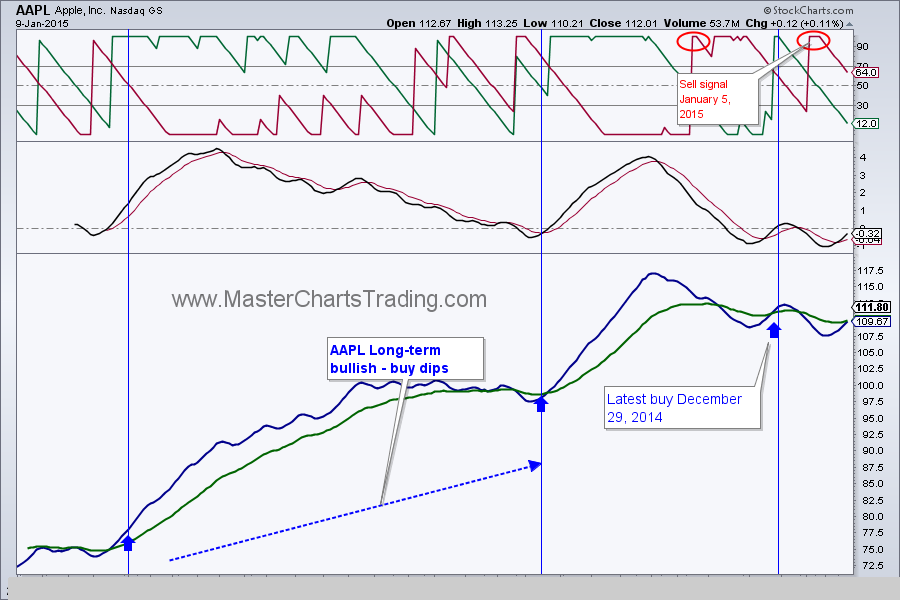

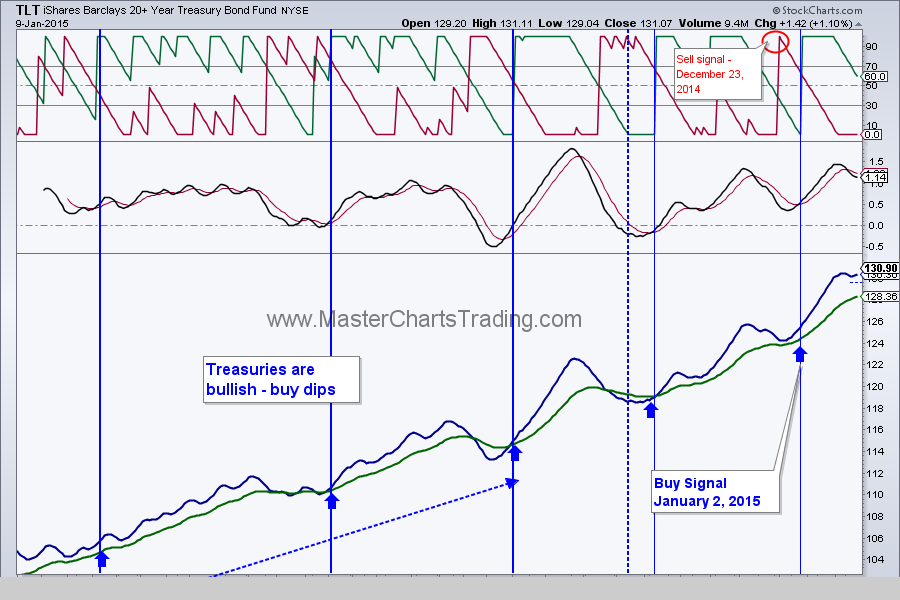

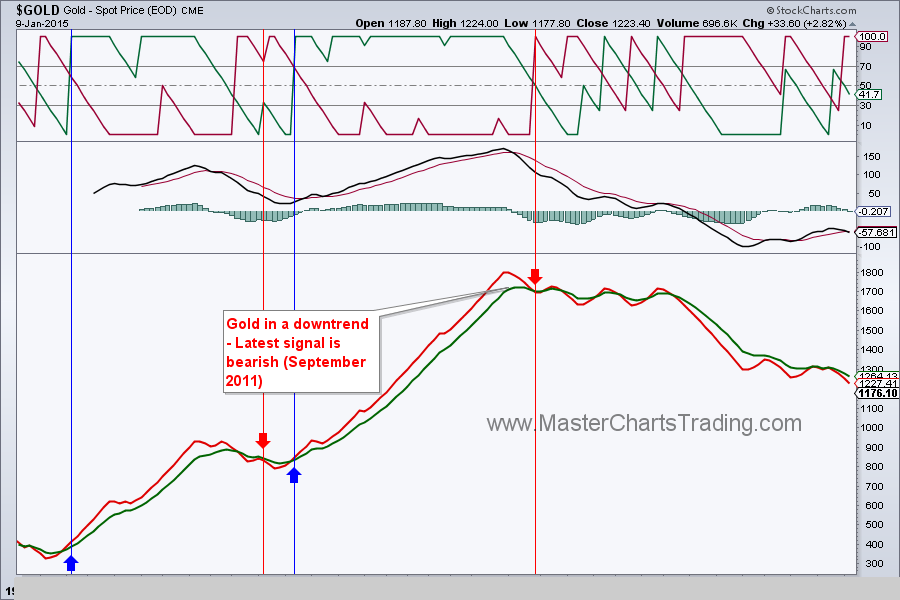

Disclaimer: we have open positions in: SPY, AGG, TLT

New position: GLD, GDX

Closed position: DUST

RSS Feed

RSS Feed