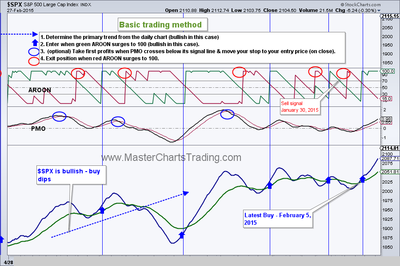

| Friday, February 27, 2015 Weekly Market Recap. Live charts for this update are located here. Major indices hit all-time highs yet again this week, but pulled back a bit by Friday to relieve the overbought conditions. I don’t think this upswing is done yet since no sell signal was generated by our trading system, although we did take some profits. Watch this video on YouTube here. | |

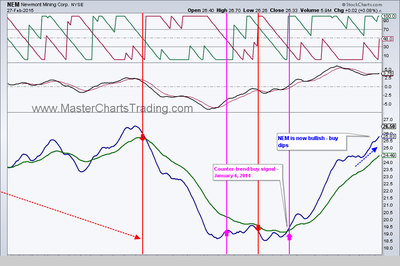

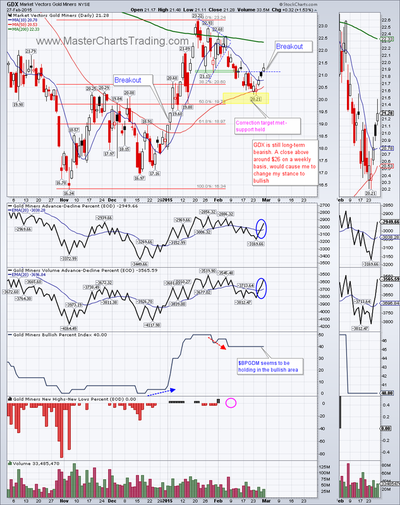

Gold miners market breadth also improved. Especially the bullish percent index ($BPGDM), when it held at 40%, was my first tell that there is underlying strength in gold miners (Newmont Mining turned long-term bullish recently).

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: SPY (took profits)

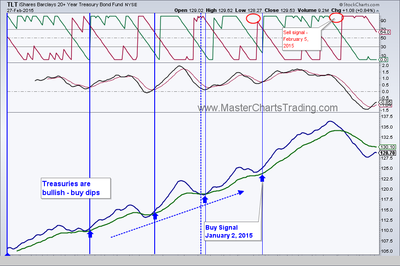

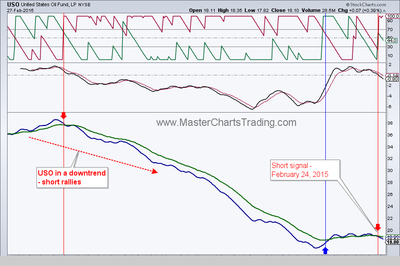

New position: TLT, SCO

Closed position: DUST

RSS Feed

RSS Feed