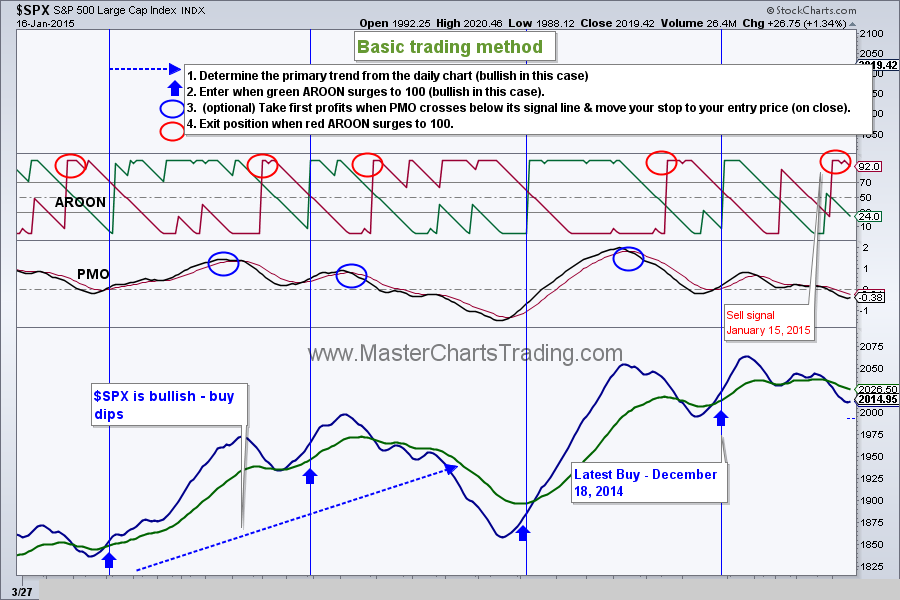

| | Watch this week's video here. Over the past several weeks, we witnessed some extreme volatility in the markets. There was lots of chatter on Twitter about it. Even some seasoned traders, who were in the business for 20+ years mentioned that they “never seen anything like this”. Again, the long-term picture for the S&P 500 remains the same – it is bullish and for us that means looking for buying opportunities within this bigger uptrend. |

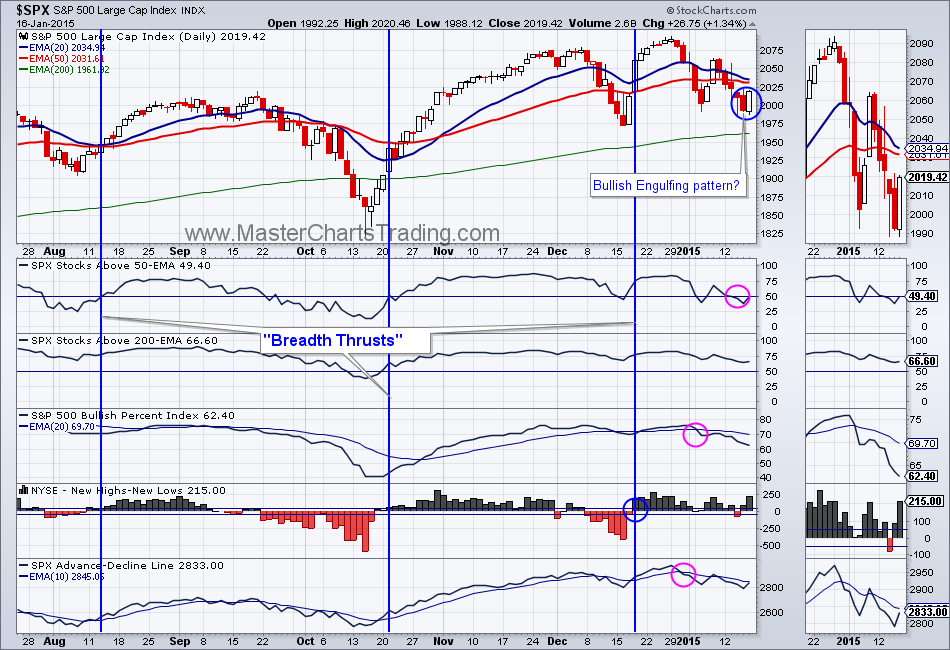

Market breadth is still more net positive then net negative. Percent of stocks above 50 day moving average dropped below 50. This means that less then 50% of stocks within the S&P 500 are above their 50 day moving average. Also, the Advance-Decline (AD) Line dropped below its January 6 low – not a good sign. Yet the New Highs-New lows indicator for $NYSE is still strongly positive and the Bullish Percent Index for $SPX is well above 50%. This indicates good participation in the market.

- That’s it for this week’s recap,

- Best Regards and have another great trading week!

- Alexander Berger (www.MasterChartsTrading.com)

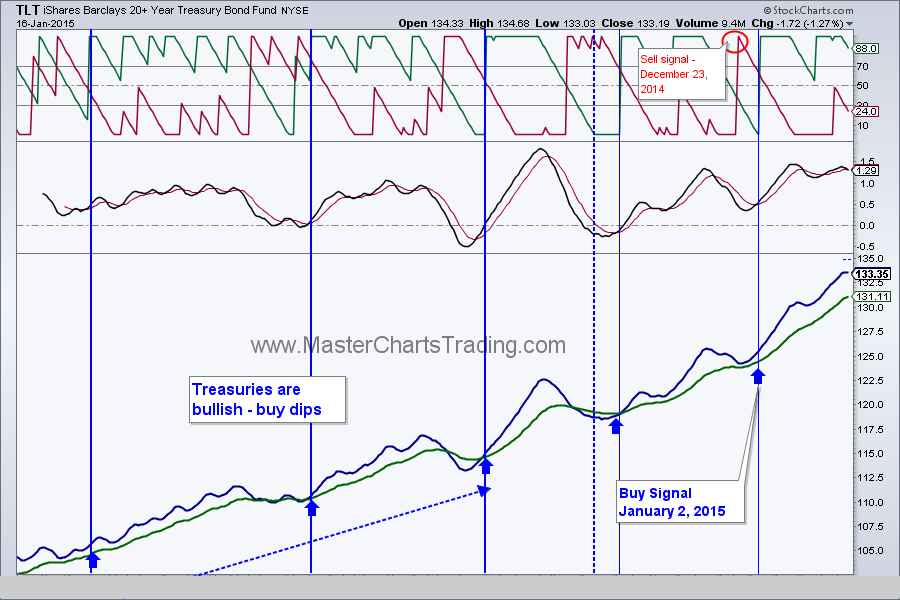

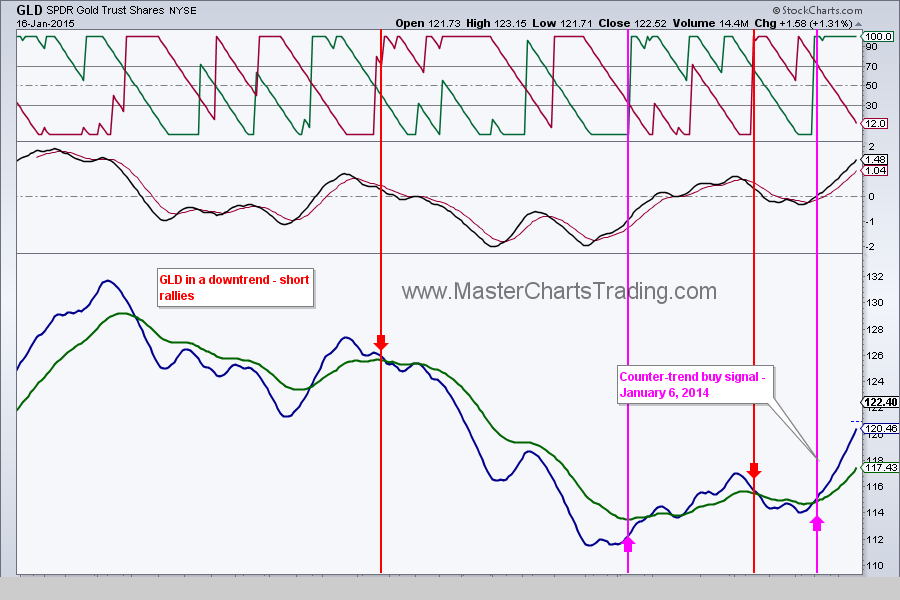

- Disclaimer: we have open positions in: AGG, TLT, GDX, GLD

- Closed position: SPY

RSS Feed

RSS Feed