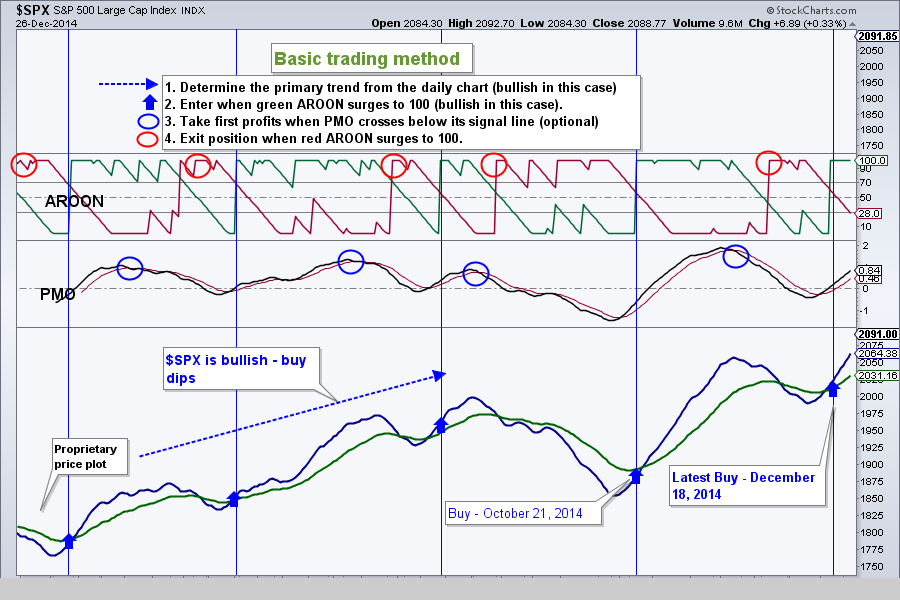

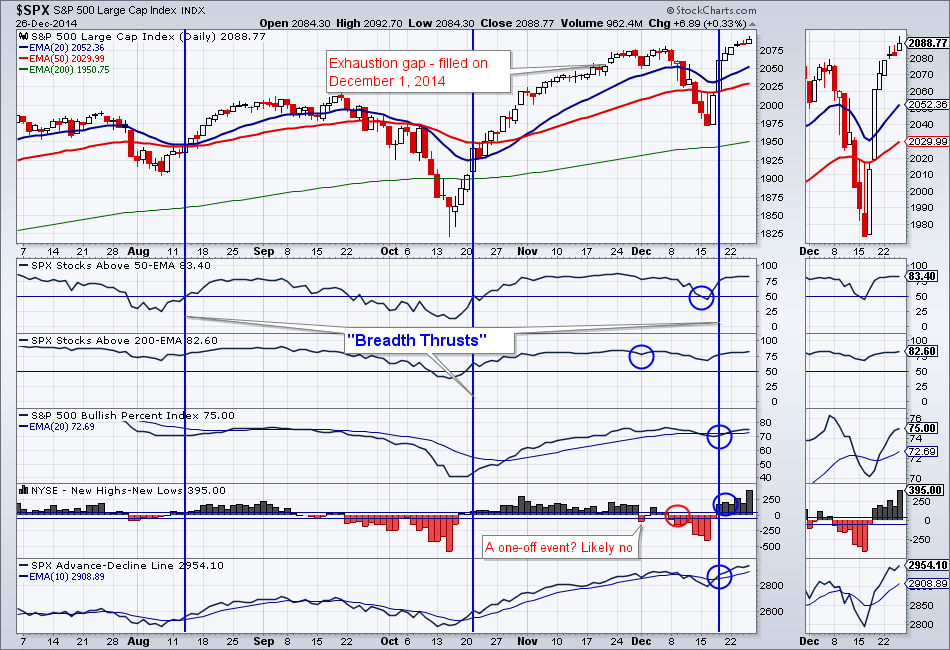

From our entry point on December 18th, the S&P 500 is up a little over 2%. The indices continue to make new all-time highs and new all-time closing highs. The stock market is clearly bullish.

That’s it for this week’s recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer: we have open positions in: SPY and DUST

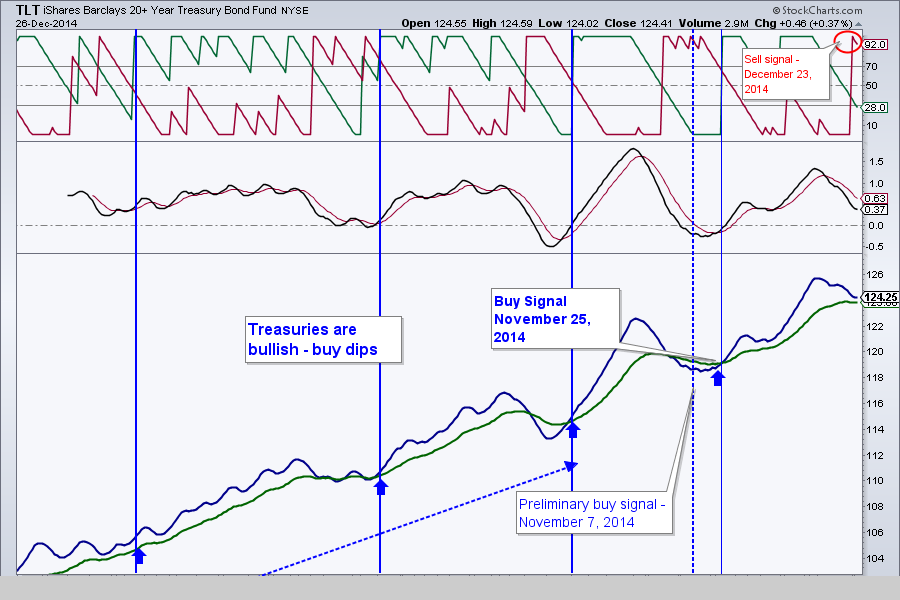

Closed position: TLT

RSS Feed

RSS Feed