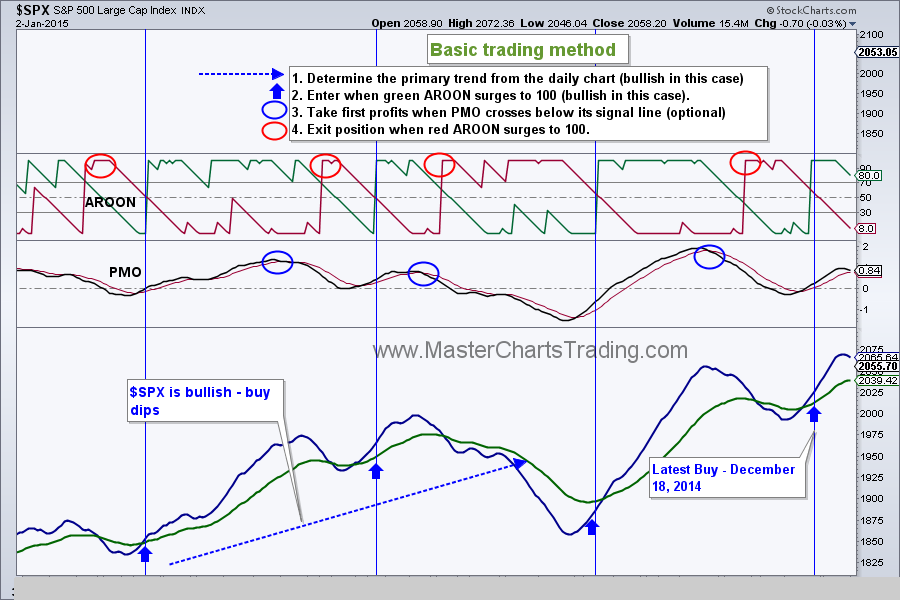

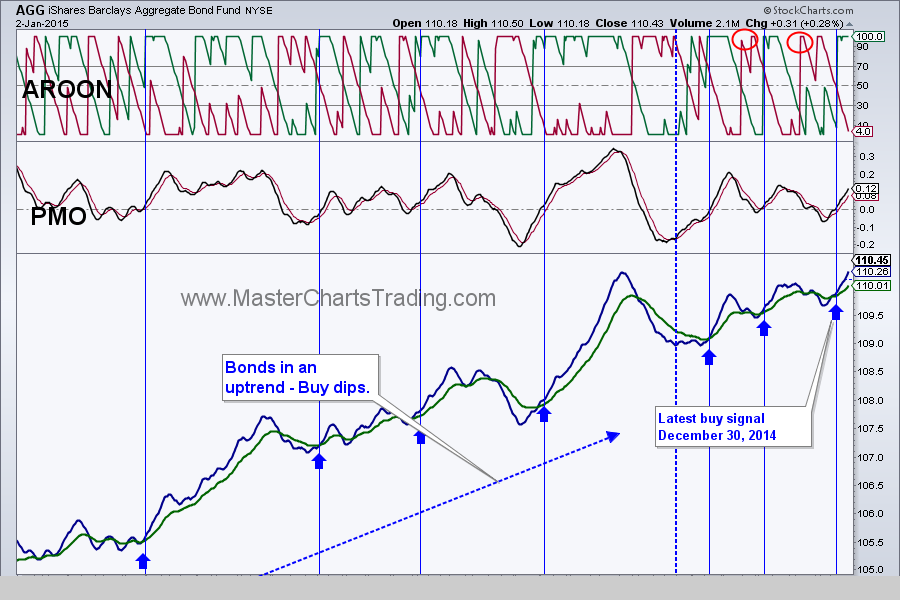

| | Friday, January 2, 2015 Weekly Market Recap. Watch video here. After hitting a new all-time high on December 29, markets sold-off rather sharply. This is a normal market behavior. Per our trading system, so far we are keeping our positions in stocks open and letting them breathe a bit. No sell signal in stocks on this upswing yet. |

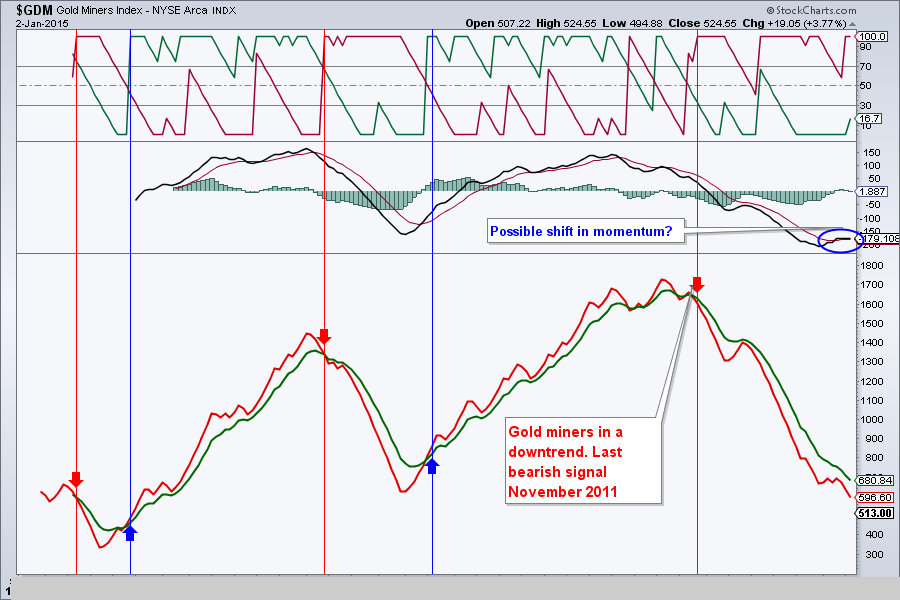

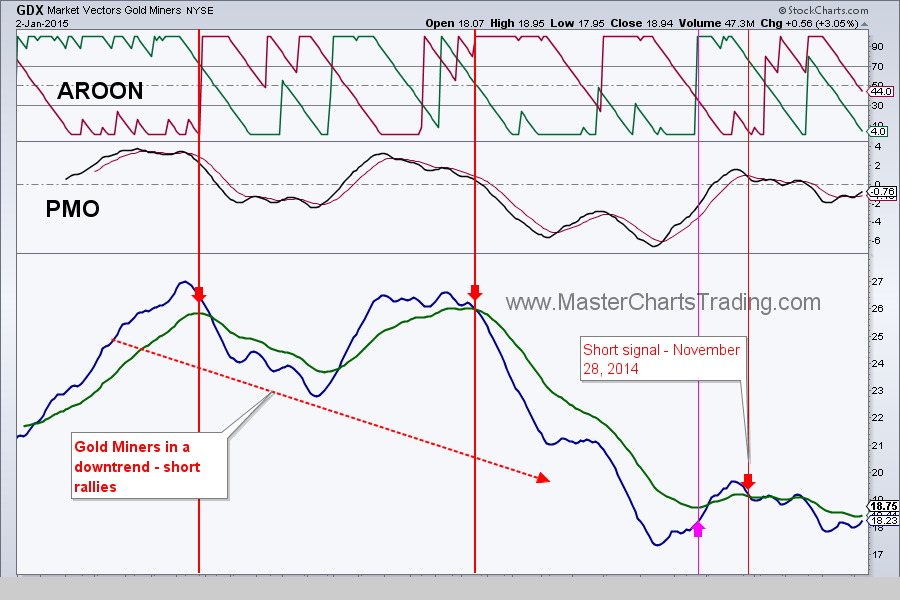

Gold and gold miners may be showing signs of either a failure of the latest downswing, or a possible long-term bottom in prices. If we look at the long-term picture on weekly charts, so far no major changes are visible. Gold miners have been in a downtrend since the end of 2011.

GDX market breadth also improved somewhat. As you can see from the chart below, there are several positive developments:

a. Bullish percent index for GDX is now at 6.67% and rising. This is hardly a bullish reading, but nevertheless an improvement from zero.

b. The Advance-Decline Percent Volume line (AD- Percent Volume line) made a higher low on December 23rd and is now also rising. This is telling me that the larger capitalization gold miners within GDX index are leading the index higher.

The rest of the gold miner’s market breadth indicators remain neutral or negative. In fact the AD-Percent line made a lower low on December 16th, while GDX itself made a higher low. This is called a bearish divergence – not a good sign.

Should GDX rally in the next few weeks and close above at least the bearish triangle trend line I drew, or better yet $20.26 (high from November 24th), I will call this latest downswing a failure. On the contrary, should GDX break the lower trend line of the triangle pattern, new lows will likely follow.

RSS Feed

RSS Feed