February 13, Thursday

Asian and European markets closed lower and that gave us concern in the morning, especially as major indices gapped down on open. However later in the day, a very robust reversal took place, and all indices closed strongly higher, printing bullish candlesticks.

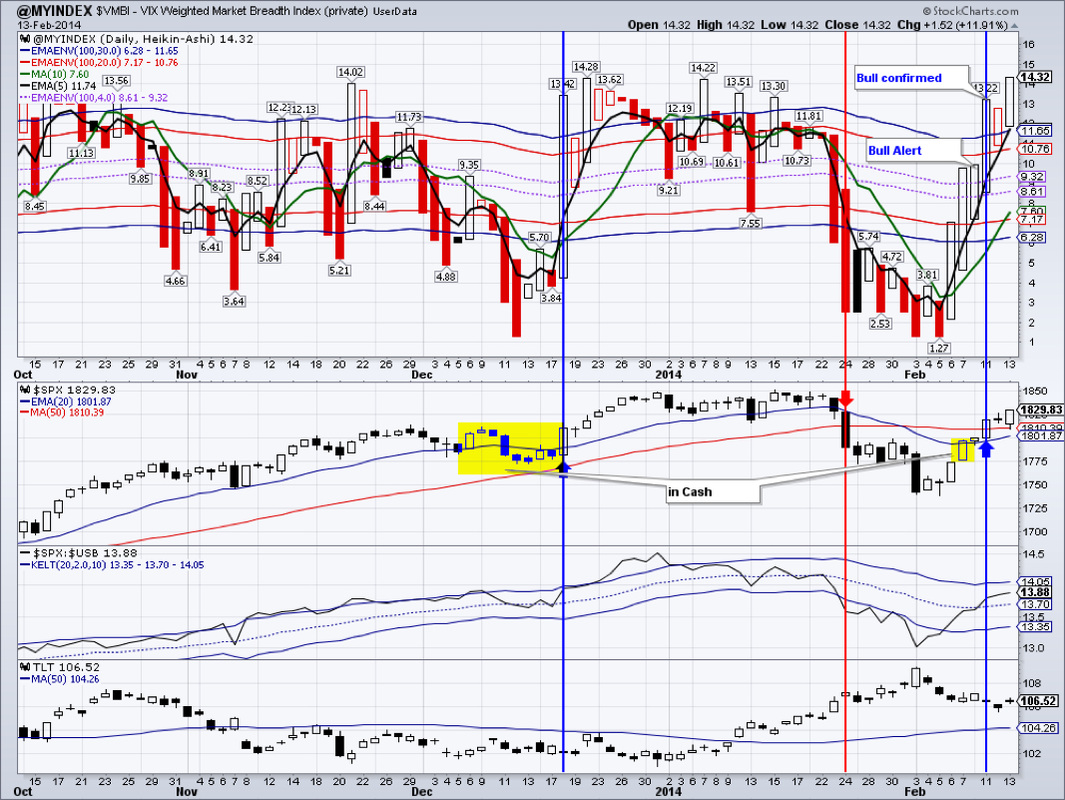

Our market breadth index, the $VMBI, flipped into bull mode on the daily chart back on February 11, and we cautiously re-entered the markets.

Friday’s close will, in all likelihood, be enough to cause the weekly $VMBI to flip into the bull mode as well. (It is currently in bull alert). Market breadth is pointing to higher prices ahead for the major US stock indices. Should the weekly $VMBI become bullish, we will add to our long positions.

Emerging markets have also rebounded strongly from oversold levels. Next week will show if this advance has legs

Rally in $GOLD and gold miners continues. A pause and digestion of this up move is likely soon. This may provide for a good entry or re-entry opportunity, should the volume and momentum remain bullish.

TLT is looking rather precarious here. It already closed below its 200 DMA yesterday, but came back up today. A decisive close below its 10 week MA on the weekly charts, would spell lower prices ahead for bonds and likely higher prices ahead for stocks. We have been stopped out of our TLT position.

We are long: GDX, IYR, DEM, DVY,

RSS Feed

RSS Feed