I posted our first video edition of the market recap on our blog.

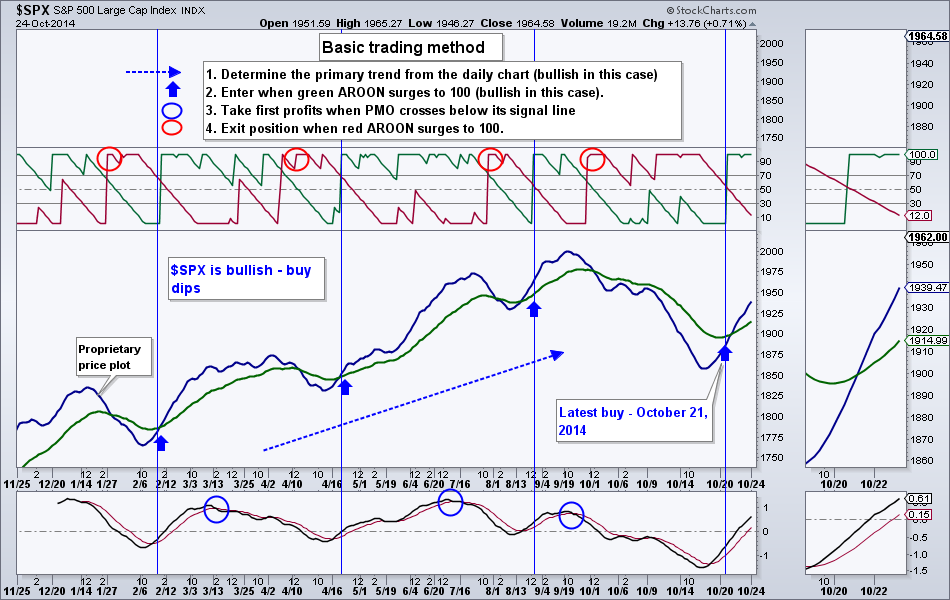

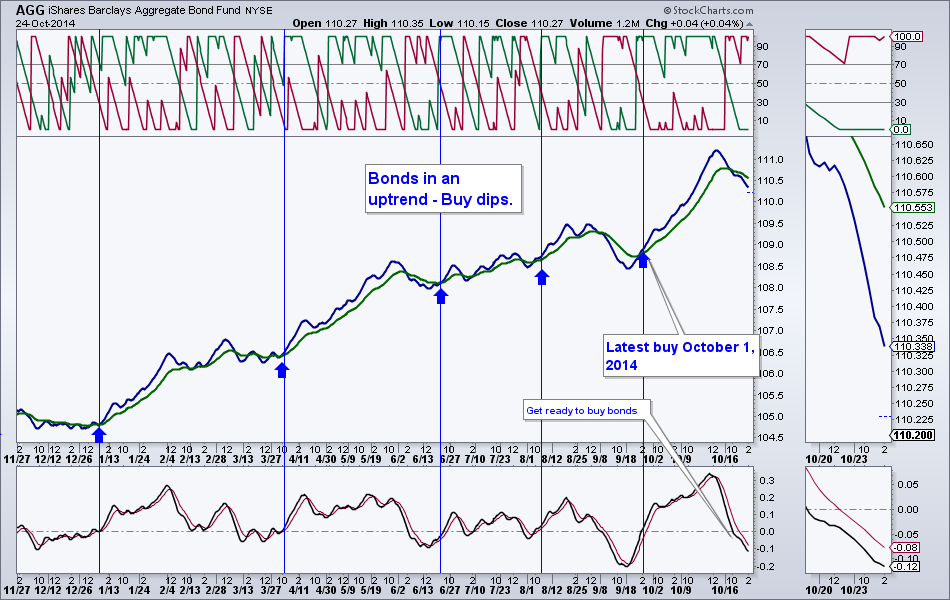

Our long-only allocation is now at 50% stocks and 50% bonds. Our model flipped to long stocks on Tuesday, October 21st.

Long-term picture hasn't changed much: large cap stocks are bullish, while small caps are somewhat bearish. We have bought large-cap stocks on Tuesday for a bounce higher and are staying away from small cap stocks for now.

Bonds are bullish long-term reflecting presence of substantial amounts of fear in the markets. Bonds (AGG) are now sufficiently oversold and ready for a bounce higher. Treasuries (TLT) haven't yet corrected to the point where I would be comfortable buying for a bounce higher.

Gold is still bearish. In fact gold miners are holding on for their dear lives. A break below $560 for $GDM could cause a stampede out of the gold equities. An alternative scenario is also possible where gold equities rally from here. Either way, stay tuned.

Commodities may be putting in a short term bottom. Looks like DBC wants to at least stop falling.

For charts mentioned in this newsletter, please click here.

Reply to this email with any questions or connect with us on Facebook or Twitter pages.

Best Regards,

Alexander Berger

www.MasterChartsTrading.com

RSS Feed

RSS Feed