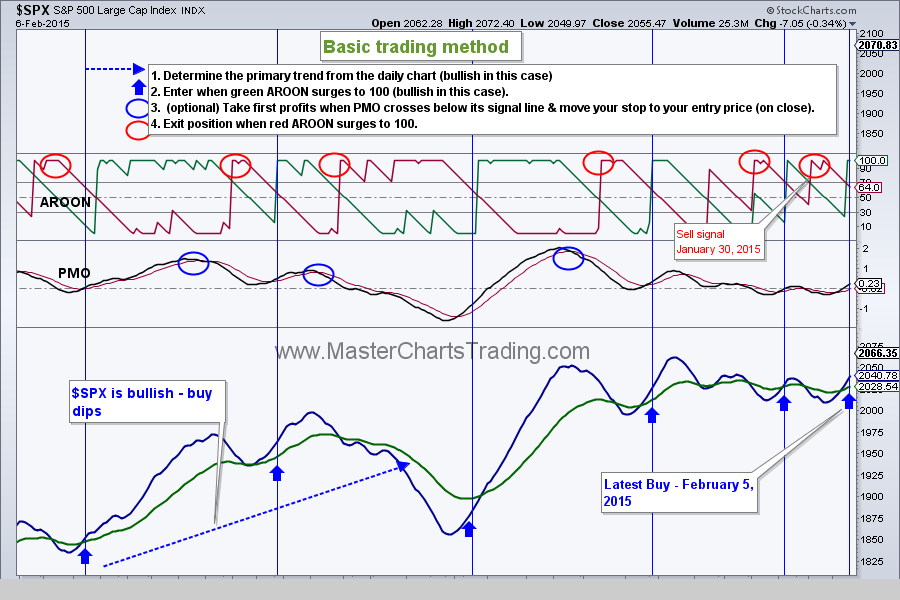

| | www.MasterChartsTrading.com Friday, February 6, 2015 Weekly Market Recap. It appears that the bigger uptrend is pulling trump again. The choppy mess of a market we have been wading through seems to be ending and new highs are now more likely then a week ago. We closed our SDS position and went long on February 5th. |

Also a bullish divergence is still present in the $NYA. Bullish divergence happens when the price of an index is trending lower, but its Advance-Decline lines are trending higher. In fact the New York Stock Exchange Advance Decline line hit an all-time high on February 5th.

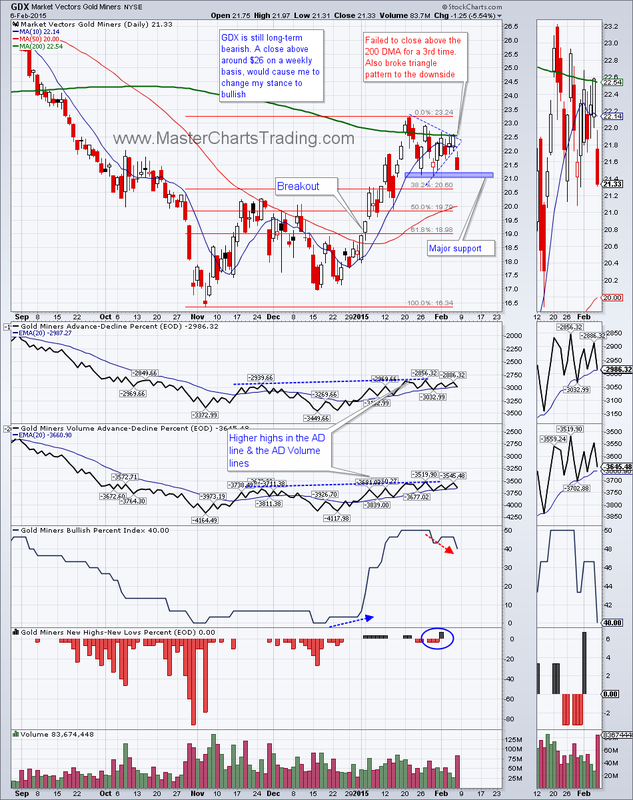

GDX failed to close above its 200 day moving average for two days in a row, now for the 3rd time. In the morning it gapped down, rebounded, and closed near the day’s lows. It is now near its major support from January 29th low. Should that give, we could easily see GDX retest at least the $20 area and possibly even lower.

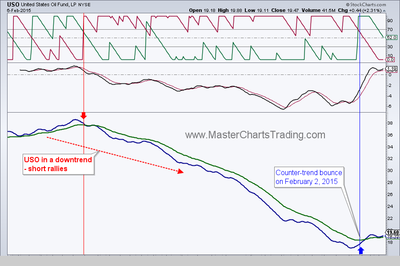

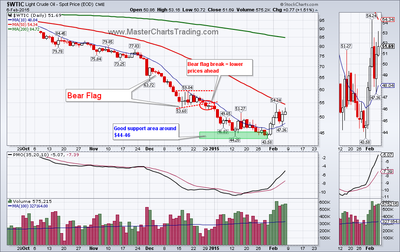

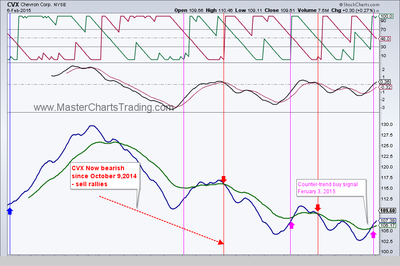

Along with oil, energy related stocks are stabilizing. For example Chevron (CVX) went on a counter-trend buy signal on February 3rd.

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: SPY, DUST

New position: SPY, DUST

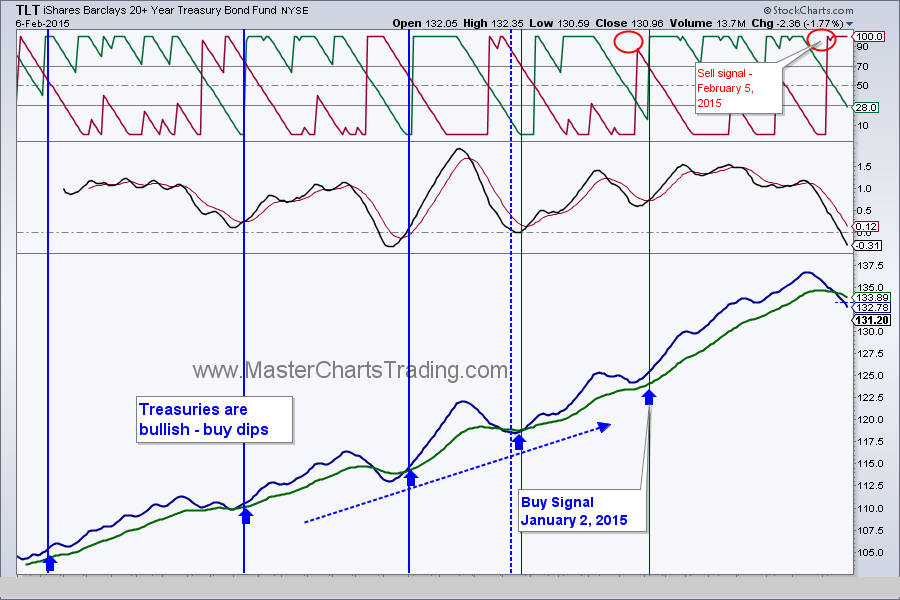

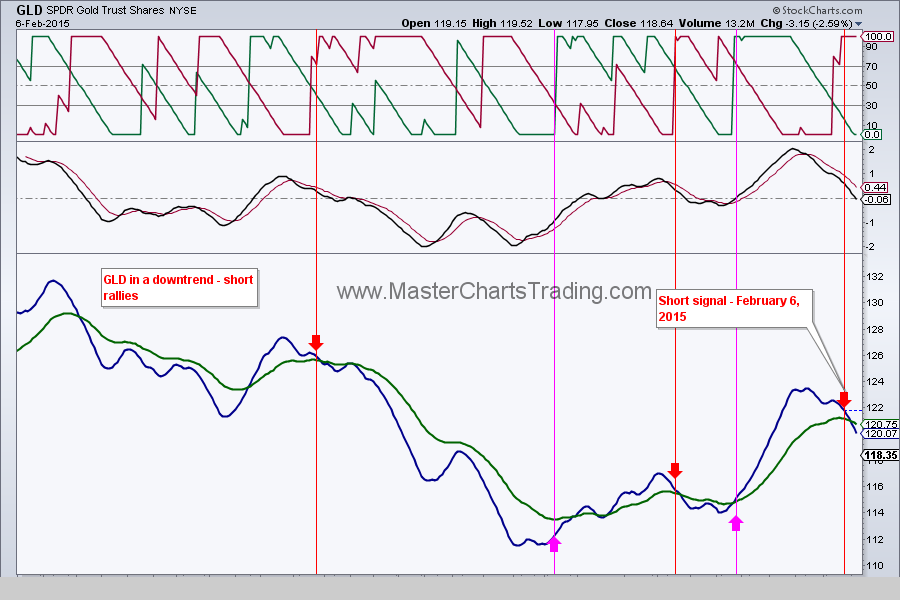

Closed position: SDS, GDX, GLD, TLT

RSS Feed

RSS Feed